How to Choose the Best Travel Credit Card for Beginners

In the last blog, I gave a brief overview of what travel cards are. In this blog, I’m hoping to help you choose a travel credit card based on your lifestyle. My key is to allow your natural everyday activities to power your travels!

P.S. If you’re not a huge reader, skip to my cheat sheet at the bottom here.

Choosing the Right Travel Credit Card*

Now that you know what travel credit cards are, it’s time for you to choose one. The most important thing to know is that your choice is personal to you. Everyone has cards for different reasons, because everyone leads their lives differently.

Step 1: Know Yourself

Before looking into any specific cards, ask yourself:

- Looking at my credit score, am I likely to get approved for a credit card?

- What are my spending habits?

- Do I spend on food? Entertainment? Activities? What is my biggest expense category?

- Do I rent?

- Are there airlines/hotels that I primarily use? If so, how much do I use those vs others?

- What credit cards do I already have? What are their perks?

- How often do I travel?

- What else do I want to get out of this new card I’m getting besides general rewards?

- Access to lounges? Priority boarding?

- What welcome bonuses do these cards offer?

Now, consider your answers. There are credit cards that can reward you more based on what you put down.

Step 2: Analyze Your Answers

Let’s zoom in to give you more info to make your decision:

Credit Score

Most travel cards require a credit score of 700+. If you have a credit score lower than this, you might want to look into cards that have no annual fee/can accommodate this. Just watch out for how much interest they might ask for.

Spending Habits

Credit cards award points in categories. Choose cards based on the categories you spend the most in. Here are the most common categories:

Rent

If you rent, there is only one credit card out there that you can earn points on rent for: the BILT card. It’s my personal favorite since rent is my biggest expense, plus it’s FREE.

Note: you have to use it on 5 separate transactions out of paying rent to get the rent points.

Airline/Hotel Preference

It makes a difference if you fly one specific airline or stay at one specific hotel brand.

If you fly one specific airline or stay at one hotel brand all the time (≥ 90% of the flights you take/stays you book), it might be worth it for you to get their specific credit card.

Use this with caution though. Depending on the airline/hotel brand, the card may or may not be worth it. Look into what you’re getting out of the card.

- For example, I find the United Explorer card worth it because I mainly fly United (it’s a major airline out of San Francisco. Plus, it’s only $95/year, but I get priority boarding, 2 annual club passes (worth $100 in themselves), a free checked bag every flight, and more.

- However, I demoted my AA card to the free tier because I wasn’t getting enough perks. The amount of spend for the amount of points wasn’t worth it.

If you don’t really stick to one airline/hotel brand, bank-based cards will give you more optionality for how you can redeem your points.

Also do your research on the worth based on the perks. Is the annual fee going to get covered + more from what you’re getting out of it?

- Ex. Chase Sapphire Reserve is $550 but you get $300 back immediately. I’ll go into more depth on each of the cards I have and what I’ve gotten out of them later on.

When looking at a credit card, it’s important to make sure the airlines you fly with and hotels you stay at are on the list of their transfer partners.

Current Credit Cards

If you already have some credit cards, it’s of no use to get another unless you’re getting different perks. Focus on getting different perks across the board to get the most out of your stack.

- For example, if one credit card offers 3x points on dining (you get 3 points for every dollar you spend), you don’t need another that also gives that.

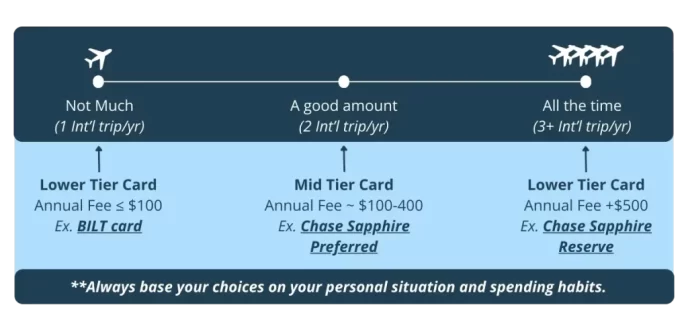

Travel Frequency

There are different tiers of cards you can get based on how much you travel. This is based on the annual fees and perks offered.

Other Travel Priorities

What else do I want to get out of this new card I’m getting besides general rewards?

Access to lounges? Priority boarding?

If you are a frequent traveler, you might be looking to get a card for perks outside of point/mile rewards. This could mean access to lounges, etc. Look into some luxury cards for this.

Welcome Bonuses

Make sure you consider the welcome bonus as well when considering different cards. You have to be confident that you can earn it as well as use it.

It makes a HUGE difference in how you start the use of the card, but don’t choose the card solely on it. Choose something that’s a balance between the bonus and its sustainable use.

The best ones offer more than this, but might be a larger spend in the first few months or might require you to pay over a larger period of time.

To get the best welcome offers, follow @zacharyburrabel. He has some of the greatest welcome offers/links listed in his link in bio on Instagram and TikTok.

Example Analysis

Here’s an example out of my own answers and show you how I leverage travel cards based on them. Here are my answers:

- My credit score is good enough for most cards.

- Most of my expenses surround dining out/food. I also spend a good amount on flights.

- I do rent. I want to get rewards for that.

- I usually fly United, it’s rare that I don’t. I’m not tied to a specific hotel chain though.

- I have a few other cards which I will cover next.

- I travel a good amount. I’m not taking international trips every month, but I’m taking a trip through an airport at least 5 times a year.

- It would be nice to get access to lounges, but I don’t need them that often.

- 60k rule, remember that!

Based on that, these are the cards that I have chosen and why (click on the toggles to see the full reasons):

The Ultimate Travel Credit Card Cheat Sheet

In case the above example didn’t have enough direction, I wanted to lay things out for you more clearly.

Here’s a quick cheat sheet on which cards you might want to get based on your biggest preferences (click on the card to learn more):

If you DINE OUT

$0 annual fee

3x points dining

$250 annual fee

4x points dining

+ grocery stores

$550 annual fee

3x dining

perks listed above

$550 annual fee

14x hotels, 7x dining

huge welcome bonus

If you TRAVEL

$0 annual fee

3x points travel/dining

$95 annual fee

3x points dining

5x points travel

$550 annual fee

5-10x travel

perks listed above

$395 annual fee

2x everything, 5-10x travel

huge welcome bonus

Conclusion

All in all, get a card that depends on your lifestyle. Let your life power your travels. That way, you don’t have to work harder to travel more, but rather give it some time and watch the rewards rack up! In case you’d like more budget hacks to see how you can travel more for less, even with a full time job and less PTO, check my tips out here.

*disclaimer: I hold no responsibility for the choices you take based on the advice of this page; it’s up to you to stay fiscally responsible and keep track of your hard earned money!